Recommended Blogs:

Foreign Investments Into American Farmland

While that is a small number overall, making up 2.7% of farmland in the U.S., the number grows each year, begging the question of how much American soil is too much for foreigners[..]

Read More

How Land Is Used To Generate Wealth And Earn Additional Revenue

Of course, what specific crops farms grow largely depends on your geographical location and expertise. At RADD America, we pursue all four profit applications outlined above[..]

Read More

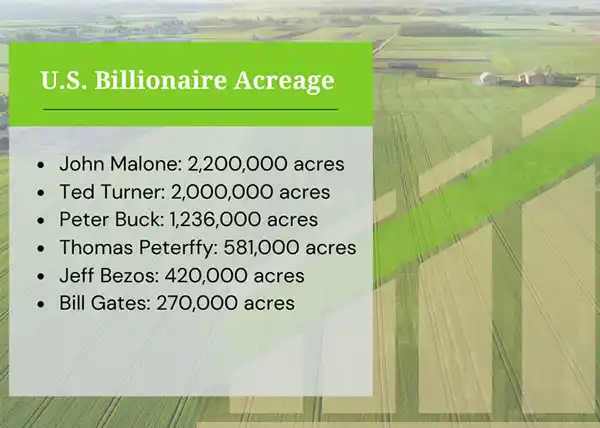

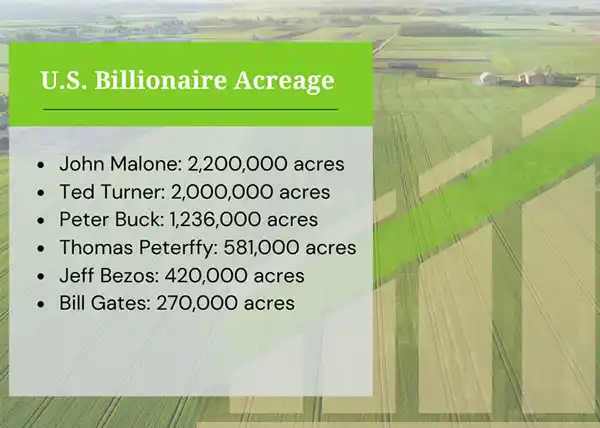

Savvy Billionaires have been buying up large swaths of American land for generations. More recently, billionaires like John Malone, Ted Turner, Jeff Bezos, and Bill Gates have backed up the truck on land investments. Even Mark Zuckerberg, who is new to the game, has also recently acquired 1600 acres in Hawaii.

Outside of long-term investment strategies, there is talk that some of these acquisitions are in preparation for inflation and a recession by hedging some of their assets in more stable commodities and markets like land. Others think they are investments to help fight global climate change and hunger; others think ulterior motives are behind the investments. Either way, these billionaires are buying American Land hand-over-fist.

What is hedging?

Hedging is an investment made solely to protect an investor's money from the decreased purchasing power due to rising prices of goods and services.

A good inflation hedge tactic is to invest in things that maintain value during inflation or increase over time (i.e., land and real estate). Historically, millions of investors have used land as an inflation hedge worldwide.

World Hunger. Sustainable Farming. Climate Change?

Let’s unpack these one by one:

World Hunger

The math is simple: the global population is estimated to grow from its current X billion to Y billion by Z year; meaning more mouths to feed with the same amount of soil.

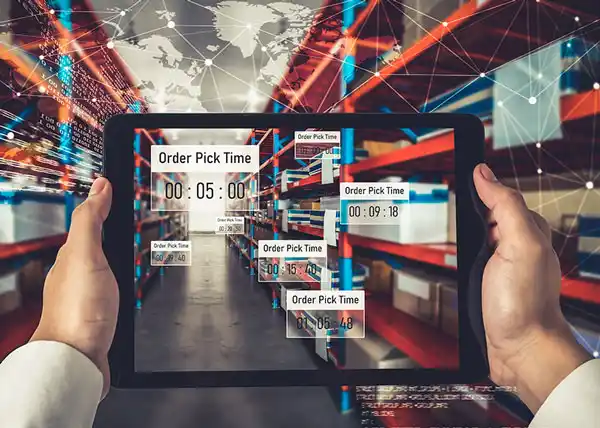

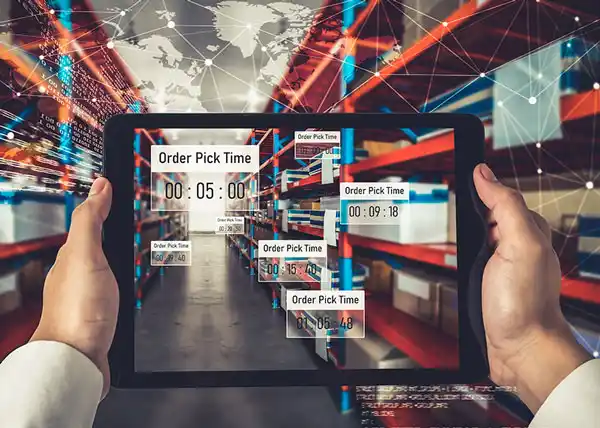

And if the scarcity of soil wasn't enough, to get the food where it needs to be, the world relies on a massive interconnected supply chain. In past years there has been very little concern over this codependent structure; however, in recent times, we have realized that the current system does not account for outside forces that may put overwhelming strain on it.

In 2020, the world went through an unprecedented pandemic, COVID-19, causing many plants to shut down. This heavily disrupted the supply chain causing many essential items to be missing on shelves, an effect we are still seeing today.

Then in 2022, the war in Ukraine broke out, again wreaking havoc on this already damaged web. Boats aren’t leaving port - even when they do, they’re stuck waiting to enter the next port. And that’s if the country the food is grown in allows food exports.

For example, on May 13th, 2022, India banned wheat exports. This policy exacerbated an already desperate wheat supply solution brought on by the dual headwinds of the pandemic combined with the war in Ukraine.

If or when more countries follow India’s lead, the global food supply situation will go from desperate to untenable; requiring more land for agriculture and increased demand for internal food production.

This crisis is leading to calls for more efficient and sustainable farming. The problem is - these solutions take time and money. And the world appears short on each…

Sustainable Farming

Farmers across the world are being forced to alter their traditional crop cycle or stop them altogether. Consider the recent news from the Netherlands…

Dutch farmers in the Netherlands are protesting proposed regulations that would dramatically affect their ability to plant crops and raise livestock. The farmers have blocked supermarkets, distribution centers, and government buildings to draw attention to what they consider an all-out assault on their livelihoods. Leaving Americans to consider if this will happen in our own country. The protests turned violent when police fired on participants in early July. Tensions are clearly hitting their boiling points and to add fuel to this fire is the hotly contested debate around global warming.

Climate Change

The camps here are sharply divided. But one thing that is not up for debate is the debate itself: governments, regulators, and companies are all scrambling to enforce, fight, or comply with the shifting environmental landscape.

These three macro factors combine to create a molotov cocktail ready to explode the world’s food supply. Food - and the land needed to produce it - has never been more critical.

It’s truly becoming a matter of national security - and the fate and wellbeing of your family could very well depend on it.

What About More Ulterior Motives?

There is speculation that billionaires are buying up farmland for other reasons that will help fuel their investments. One of these ventures is a push towards producing “synthetic meat.” The word synthetic is meant to detract you from what it actually means- lab-grown. How would you like your lab-grown ribeye cooked? See, it just doesn’t have the same effect or sound as cool as synthetic.

It is speculated that this method of meat production will be better for the environment. However, the cattle industry is reluctant to see how this will be an affordable alternative as one lab is paying an estimated $10K to produce just one pound of this lab-grown experiment - all to reduce an estimated 2% of methane gas production worldwide.

Billionaires have always had long-term investment strategies, but when you compile this speculation with the sheer amount of land that they control, it is concerning to say the least. But even if that’s not the case, it doesn't matter. With billionaires buying up everything, this will limit supply. Limiting supply will do one thing: send prices higher. Economics 101.

And remember, billionaires aren't the only ones buying American Land as fast as they can… Check out who else is investing in American Soil.